.jpeg)

By prioritizing capital allocation in these areas, governments can drive sustainable development and improve the socio-economic conditions of their citizens. Human capital refers to the collective skills, knowledge, and experience possessed by individuals, which are pivotal in influencing productivity and driving economic growth. This form of capital encompasses education, training, and the expertise gained through work experiences, all of which enhance an individual’s ability to contribute effectively in the workplace. Organizations that invest in developing their human capital often experience increased efficiency, innovation, and adaptability, leading to improved performance and competitiveness.

What Does Capital Mean in Economics?

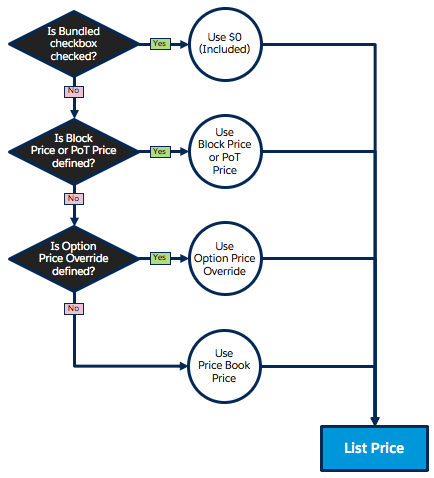

By allocating resources toward cutting-edge technologies, companies can enhance their operational efficiency, streamline processes, and improve product quality. This not only boosts productivity but also positions them favorably against competitors. The term ‘capital’ has different meanings in different contexts—depending on usage. For example, in economics, any form of liquid asset which can be easily converted into cash is known as capital. But in business and finance, the same term refers to a sum that is invested in an organization to produce goods and services and create value.

Intangible Assets

- Capital is the lifeblood of any business, and its importance in economics and finance is also undeniable.

- Capital gains are exactly as they sound—your invested capital gains value after an investment.

- In 2020, for example, corporate bond issuance by U.S. companies soared 70% year over year, according to Moody’s Analytics.

- Learn about the definition, usage, structure, and various types of capital in finance.

It can be used to what is capital increase value across a wide range of categories, such as financial, social, physical, intellectual, etc. In business and economics, the two most common types of capital are financial and human. Companies raise debt capital by selling bonds and raise equity capital by selling additional shares of stock. The contents of a bank account, the proceeds of a sale of stock shares, or the proceeds of a bond issue all are examples. The proceeds of a business’s current operations go onto its balance sheet as capital. For equity capital, this is the cost of distributions made to shareholders.

A Beginner’s Guide to Effective WhatsApp Marketing in 2024

To learn more, read CFI’s guide to the weighted average cost of capital (WACC). Capital can also refer to capital assets, which are financially significant assets with a longer lifespan than one year that are intended to be used to generate profit through use rather than being sold. The most common capital asset a company has is PP&E, or plants, property, and equipment. Capital can also refer to capital assets, which are financially significant assets with a longer lifespan than one year that is intended to be used to generate profit through use rather than being sold.

.jpeg)

Furthermore, a highly skilled workforce not only boosts individual earning potential but also contributes to overall economic prosperity, making human capital a vital asset for both businesses and economies. In a sole proprietorship or partnership business, the majority of funds are invested personally by the owners—or in the form of personal loans taken from a bank or financial institution. When it comes to larger corporations, funds are raised through debt or by the issuance of equity. Every firm requires funds to undertake day-to-day business operations—and to cover cash flow requirements. Financial capital is generated primarily through debt and equity and, to a lesser extent, retained earnings. Without financial capital, a company won’t be able to produce the goods and services it sells.

When economists look at capital, they are most often looking at the cash in circulation within an entire economy. Capital assets are generally tangible, illiquid, long-term assets that carry higher value compared to ordinary assets. Capital assets often have a benefit that extends beyond one year, and companies usually use capital assets as an integral part of their business operations. Companies often also represent personal assets of an individual; in this situation, capital assets are the significant pieces of investment that person owns. In free market and laissez-faire forms of capitalism, markets are used most extensively with minimal or no regulation over the pricing mechanism. In state capitalist systems, markets are relied upon the least, with the state relying heavily on state-owned enterprises or indirect economic planning to accumulate capital.

Natural Capital

Analysts may use several different ratios as part of their analysis of a company’s capital structure, including the debt ratio, which is the ratio of total debt to total assets, expressed as a decimal or percentage. The D/E ratio indicates how much debt a company is using to finance its assets, relative to the value of shareholders’ equity. Debt (from lenders) and equity (via investors) are two of the main ways a company can raise money. A company’s debt typically includes its short-term borrowing, long-term debt, and a portion of the principal amount of operating leases and redeemable preferred stock. A capital asset is an asset with future economic benefit often extending beyond one year. These assets may be liquidated in worst-case scenarios, such as if a company is restructuring or declares bankruptcy.

What Defines a Capital Asset?

It represents the collection of resources that humans or groups of humans possess that can be beneficial in generating revenues. Tangible assets represent all the assets having a physical existence and are required to generate income for the business entity. We are not going to talk about the capital structure of any company and how capital structure relates to business value and operations. However, in most cases, capital refers to the financial capital required to run business operations. Capital can be used either to fund day-to-day operations (via working capital), for expanding business or as a set-aside emergency fund to weather economic storms. There are four main sources of business capital are equity, debt, government grants and business revenues.

Capital assets are usually illiquid, meaning they can’t be quickly converted into cash to pay for expenses. Working capital is the money you have left over after using your current assets to pay for current liabilities. Current assets include resources you can liquidate within one year, like cash, inventory, and accounts receivable.

(Total available capital includes long-term debt, preferred stock, and common stock.) These ratios provide insight into how risky a company’s borrowing practices are. At its core, capital refers to the financial resources a business possesses, which are utilized to enhance production and generate profits. It serves as the foundation on which a business can grow, invest, and tackle new opportunities.

These resources can take many forms, such as financial investments, equipment, or intellectual property, all of which contribute to productive activities. A comprehensive understanding of capital is essential because it influences economic growth, business efficiency, and personal financial planning. By effectively managing and deploying capital, individuals and organizations can create long-term value and drive sustainable development. Financial CapitalFinancial capital refers to the funds that businesses utilize to acquire physical capital and other essential resources needed for their operations and growth.